Services

Separately Managed Account (SMA)

Separately Managed Accounts (SMAs) are very similar to our Currency Overlay service in that they can add another dimension to currency risk management rounding out an overall program. However, the main difference is that the SMA may have a different base currency and / or risk objectives than the company's actual underlying FX exposures, and may require the establishment of alternative FX and hedging facilities (e.g. credit lines). Companies often use SMAs when they want their underlying FX exposures hedged separately from a more alpha (i.e. profit) seeking risk management strategy that seeks to capitalize from various currencies' mismatch in terms of Value, Carry and Momentum. SMAs are generally funded by cash deposits (i.e. margin) and positions are netted and cash settled for a profit/loss rather than an actual exchange of the position's underlying notional value. Compared with traditional, Passive Hedging or Currency Overlay, SMAs take advantage of leverage meaning that the deployment of cash for margins is more efficient by utilizing an SMA, that is to say, initial and maintenance margins can often be 25% to 75% less. A dedicated currency specialist, focused exclusively on adding alpha via currency exposure will employ strategies utilizing a blend of a fundamental, discretionary and systematic approaches.

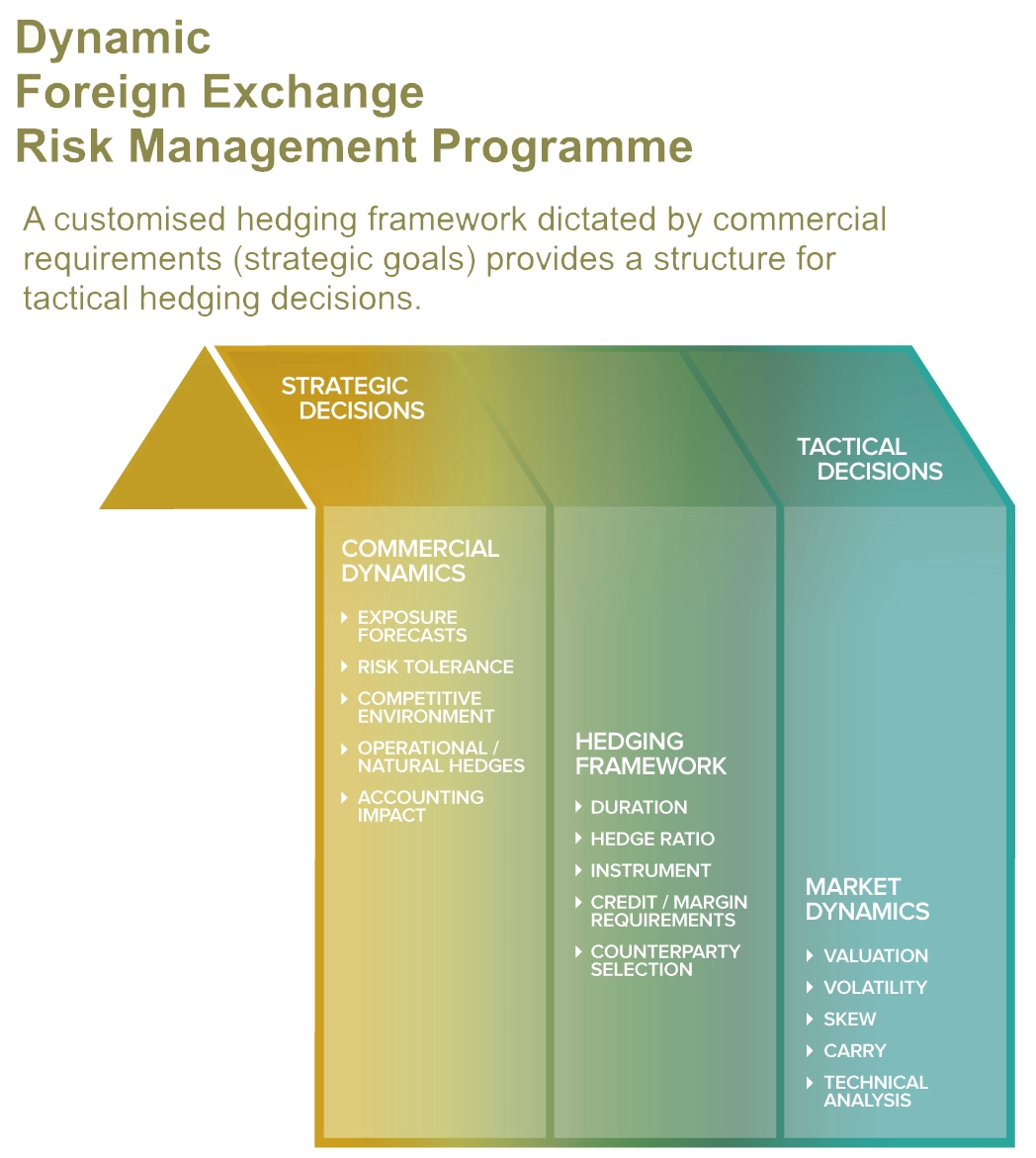

Dynamic Tactical Hedging

Within the context of a structured hedging program, we provide tailored and proactive currency market analysis to identify tactical hedging opportunities, and we work with clients to regularly calibrate hedging strategies to ensure continued alignment with changing business requirements and market conditions. Our advisory service and interactive technology ensures that underlying FX risk and hedging activity is monitored and reported in an intuitive and actionable format.

Currency Risk & Control

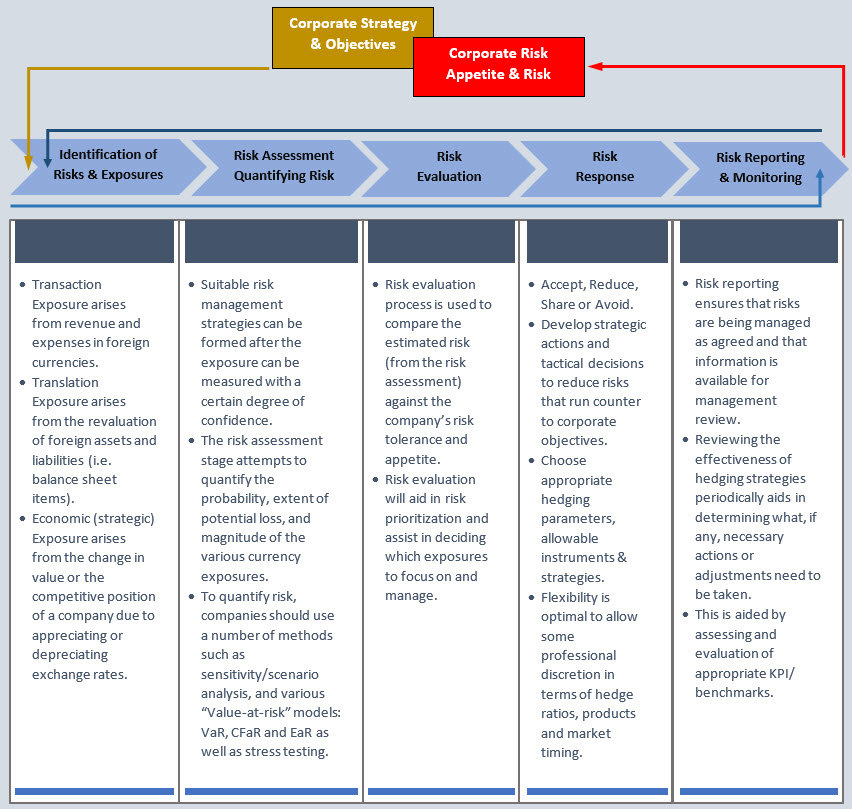

Foreign exchange volatility can impact an organization in many ways, from creating near term cash flow and earnings volatility, to influencing competitive position and strategic opportunities over longer time horizons. Fully understanding the multi-faceted relationship between FX movements, underlying commercial dynamics, and other risk exposures is essential when designing an effective currency risk management program. At MCAP FX, our methodology involves a careful quantitative and qualitative analysis of currency exposure, internal business considerations, objectives and constraints to facilitate the design and implementation of a robust risk management strategy. This will often combine internal process changes in combination with a financial hedging program, to maximize hedging effectiveness whilst minimizing hedging costs.

MCAP FX leads the industry in foreign exchange services. Our Corporate Foreign Exchange Traders put the "Person" back in Personal; right where it should be!

Free Consultation